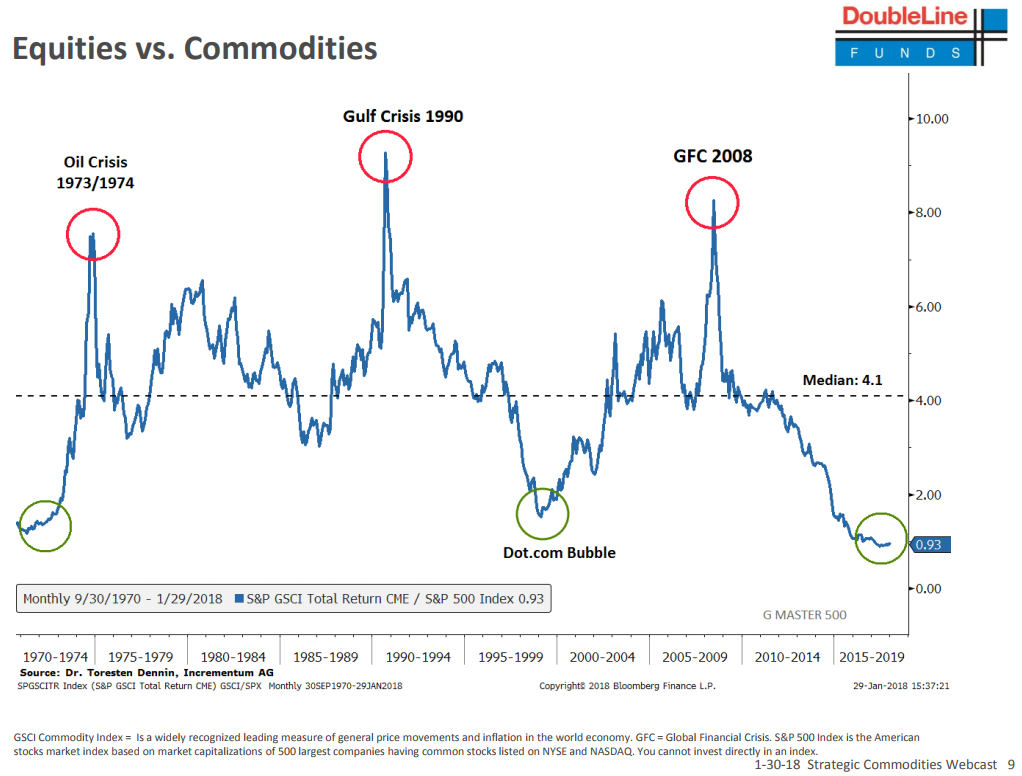

Outlook for the 2020s and Okay, So What Do I Do Now? concluded that on the basis of valuations commodities are likely to outperform US stock over the coming decade. A related point is that relative returns between US stocks and commodities have tended to oscillate in long sweeping cycles. DoubleLine, led by famed investor Jeff Gundlach, has produced a chart visualizing this phenomenon that strikingly illustrates this, and the ‘you are here’ point at which the chart concludes is a persuasive omen of the this likely outperformance over the coming years. This was referred to in my first reply to JK in the former of the two posts linked above.

Next let’s look at nonUS stocks. As with commodities, I didn’t attempt to lay out a detailed argument in my earlier posts, but rather focused on the big picture. My valuation logic isn’t original with me anyway … rather I’ve sought out the work of the best and brightest in the field. In the case of stocks, that includes a number of leading lights, such as Grantham, Mayo & Van Otterloo and Research Affiliates. The latter firm recently published an article on Advisor Perspectives that discusses nonUS stocks versus US stocks that provides much of the intellectual heft for the likely outperformance of the former. Although this research breaks nonUS stocks into separate categories of “emerging” and “developed” (EAFE: Europe, Australasia & Far East), I believe this categorization of foreign markets is increasingly arbitrary and obsolete (not to mention fails to find a place for important markets like Canada), and in any case not particularly helpful to break out anyway since they’re both pegged to substantially outperform the US. Suffice it to say RA (as well as GMO) agree nonUS stocks are set to outperform their US counterparts in the coming years:

gmo’s 7 year projections have for some time been pointing to emerging market value as the sector most likely to succeed. the closest approximation to that that i’ve been able to identify are the etf’s dem and dvye. got anything better?

Funny you should mention that, JK. On the same GMO opinion, I also recently looked for such ETFs and came to the same conclusion. Ultimately I passed on those options due to a combination of not quite hitting the target and fairly high expense ratios.

Even broadening the search for general exUS value turned up nothing particularly tempting. Striking considering the huge number of ETFs available these days. You can find the US market sliced and diced in numerous ways, but exUS not so much, at least not without also introducing other variables like coverage gaps (eg cap limits, no Canada (EAFE & EM)) that you don’t necessarily want. So at this point I just use factors for US ETFs and treat the rest of the world as a whole. VXUS remains my fund of choice for the latter. Given its broad diversification, liquidity, ultralow expenses, and the positive outlook as a whole for exUS equities, it’s not a bad approach. I’d be skeptical about getting too granular on a multiyear forecast anyway.

If I could find an exUS counterpart to WisdomTree’s DTD (whole world exUS, all cap, weighted by total expected dividend payout) for a reasonable expense ratio I’d buy it in a heartbeat. Unfortunately no such ETF as of yet exists.

Again not quite on the nose, but maybe worth considering … emerging market local currency bonds. One such ETF is EMLC. Due to the currency component (certainly not fixed income in USD terms), I’d treat them as part of an equity allocation. With a yield in excess of 6%, they could stake a claim as EM value…