In this second quarter of 2020, the one thing that is more certain than ever is uncertainty. Mere weeks ago economists were debating the odds of a recession; the world economy is now in a depression. How can anyone make rational investing choices when things can change so much in so little time?

On one hand, we could be looking at not a month or two of coronavirus motivated shutdowns, but possibly a year or two:

On the other hand, the most brilliant scientific minds in the world are on the case, looking for therapies and preventatives. Government medical regulatory policies have become more liberty minded, reducing bureaucratic obstacles and greasing the skids for medical solutions, as we pointed out in A Ray Of Hope. While incremental advance is the most likely path forward, a breakthrough could be announced at any time.

On one hand, to boost asset prices policymakers have put the medal through the metal on economic control and financial market manipulation. Monetary and fiscal policy in the US have effectively merged, and a multi-trillion dollar fire hose has been mainlined into the financial system.

On the other hand, these measures are deadly poison for the longer term economic outlook, as we discussed in The Biggest Threat To The Economy.

On one hand, even after the recent plunge in stock prices, US stocks remain overvalued. Long term returns are likely to be far below those our parents and grandparents generations enjoyed, possibly even negative:

This well-known measure puts the S&P 500 at 35% overvalued

On another, these low prospective returns could nevertheless outperform cash. Given the policy environment, dollar depreciation could easily exceed stock depreciation, leading to positive nominal stock price returns. A portfolio of US stocks could buy you less in five or ten years than it does today, but still more than a portfolio of dollars. On another yet, the level of debt in the system going into this means powerful demand for dollars, which could outstrip even the massive supply increase under way for an undetermined period of time.

On one hand, foreign stocks as a whole are, in contrast to US stocks fairly to attractively valued, portending better long term returns. On the other, dollar debt and dollar demand, as noted above, could overwhelm the valuation tailwind for who knows how long. Not to mention the grim fundamental outlook stemming from the threat to free markets everywhere.

Yet, boil all this down and it is clear that the basic principles of investing haven’t changed. The fact that we can’t know the future with any certainty has always made diversification wise, and with the unknown more unknown than ever, diversification is more important than ever. With that in mind, we might engage in some informed speculation about what to expect.

I continue to believe investors should have a mix of bonds, stocks and gold. The bond portion would emphasize credit-risk-free bonds, usually sovereign bonds denominated in their own coin of the realm. For US investors, that means US Treasuries. Owing to the ubiquity of US dollars in global commerce, even non-US investors may consider some UST exposure in addition to their own sovereign bonds. The principal risk to such bonds is inflation. You’re virtually certain to be paid the promised principal and interest, but likely in currency units of diminished purchasing power. In contrast they should do well in deflation.

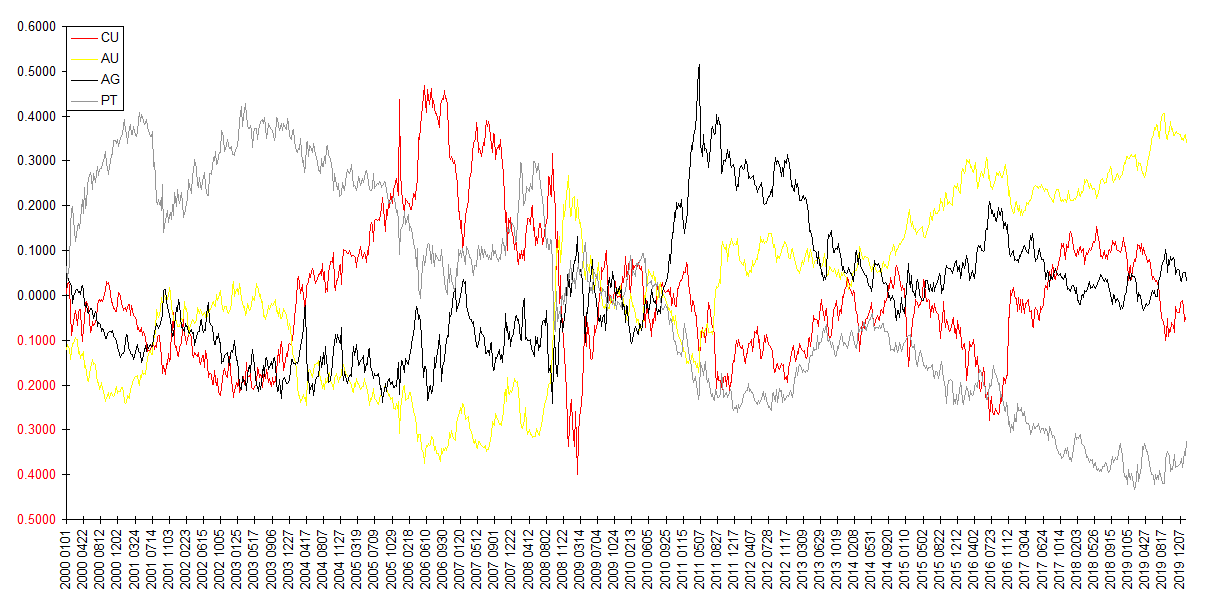

Stocks and gold should protect better in inflation. As suggested above, even if stocks are losers in real terms, they could nevertheless outperform currency, and by extension, bonds denominated in currency, if currency depreciates. Gold continues to be a valuable diversifier in a world where most financial assets are overvalued. Other physical commodities are worth consideration as well, such as copper, silver and platinum. Silver for example is historically inexpensive relative to gold. Platinum even more so:

In general, commodities are undervalued relative to financial assets, as we discussed in Commodities & NonUS stocks. Historically however, most commodities are more correlated with stocks than is gold. So while non-gold commodities may offer better prospective long term returns, be aware that when stocks fall, they’re more likely than gold to decline in sync, so gold remains the most effective stock diversifier. In general, the weak point of gold and other commodities – that they have no yield – loses its validity as financial assets get higher in price and lower in yield. So the more aggressively the world’s central banks act to prop up financial asset prices and drive their yields down, the more valuable gold and other physical commodities become.

We’ve devoted a disproportionate share of space here to nonfinancial assets not because we think they merit a disproportionate share of an investment portfolio, but to counter the widespread notion that a portfolio is adequately diversified merely by virtue of containing both stocks and bonds. Like a three legged stool, a portfolio of three asset classes is sturdier than one with only two.

For ETF investors, I like GOVT for Treasuries, VT for stocks, and IAU for gold. Income oriented investors could consider a mix of DTD and VXUS for part of the stock allocation. Large portfolios could include small allocations to SLV, PPLT, and JJC for more physical commodity diversification. For Treasuries, iShares’ GOVT is convenient because it collects the whole range of Treasury maturities from a year in out in one ticker, but larger portfolios could also benefit from the lower cost Vanguard Treasury funds VGSH, VGIT and VGLT.

A key concept to help guide our thinking seems like it goes without saying, but is one of the most commonly disregarded truths of investing. We use currency units as our measure of value, as if their own value is stable and unchanging, but it’s not. If the S&P rises by 1%, we have no way of knowing from that observation alone whether stocks actually rose in value or if dollars fell. Even “the dollar” in forex markets is of little help with this, since it only reflects how the dollar fared in relation to other currencies which themselves vary in value. This has practical implications for your investment portfolio. To the extent loss avoidance in currency terms is a priority, a higher allocation to cash and bonds is warranted. To the extent real performance is a priority, a higher allocation to stocks and gold may be. The popular “risk on” or “risk off” view of investment assets is a deeply flawed paradigm. Every investor defines risk for himself.

The link to the Article by Mark Hulbert, where he focused on valuation by discounting future cash flows, called out a possibility of a “return to normalcy,”

First, there is, and has been, nothing normal about an economic system centered around money creation out of “thin air.”

Second, the whole discounted cash flow method, aside from the speculation of picking a proper discount rate as the article called out, also rests on the proposition that humans have the capacity and inclination to accuarately forecast future cash flows and assign accurate values to them. I am not aware that this has been proven, or is regarded as provable. I will contend it has as much validity as the efficient market hypothesis – – – not much.

Instead, valuation tends to be more dependent on FED and government action, behavioral science, machine algorithms, wealth divides, etc.

Interesting point, cb. I’ve been contemplating a post on that very subject: what exactly is the “normal” we will or should even aspire to return to.

Re discounted cash flow (DCF), it’s helpful to distinguish between theoretical validity and practical application. DCF is like an algebraic equation. There are two separate questions: The validity of the equation itself and the reliability of any result obtained based on the data put into it. I doubt Hulbert has any illusion about that.

Even with all the with the questionability of the data, I think Hulbert’s use of the method is solid. What he’s doing here stops well short of claiming the S&P is worth any exact figure. Rather, he’s making a comparison across time. That if you apply the same method to the same data now as you did historically, that the S&P would sell at around 1800 in order to expect the same prospective returns as seen historically. And that therefore at current prices the market is likely to return less than historically. This notion, that valuation is a strong predictor of long term returns, has been statistically validated over decades of market data. So there is not only theoretical but empirical evidence to support it.

Your point about government and central bank action is especially relevant, because it is these kinds of antics that cause the market to be priced above where it ‘should’ be based on historical parameters. Otherwise we probably wouldn’t have such an overvaluation situation and we could invest with a better expectation of having something in the realm of historical rates of return.

Moreover, it also highlights the importance of distinguishing between real and nominal returns. In the long run, there’s nothing the government and Fed can do to make stocks intrinsically worth more. They can, however, make dollars worth less. Bear in mind that when we say the S&P is at 2400 or whatever, we’re omitting the unit … it’s not an absolute measure of value, but an aggregation of prices in dollars. It’s a ratio of the value of stocks to the value of the dollar. To increase the index, it works just as well to decrease the value of dollars as it does to increase the value of stocks. By this sleight of hand, our central planners can make stocks appear to rise in value whether or not they actually do.

And that’s exactly what happens. In the last post, The Biggest Threat To The Economy, I demonstrated how by a mere change of units you can conclude that US stocks returned either 245% or -35% over the first twenty years of this decade.

In light of this, it’s fair to say that while valuation based forecasting methods like DCF could be radically off the mark if interpreted to mean nominal returns in dollars, they’re nevertheless the best predictors we know of of long term real returns.