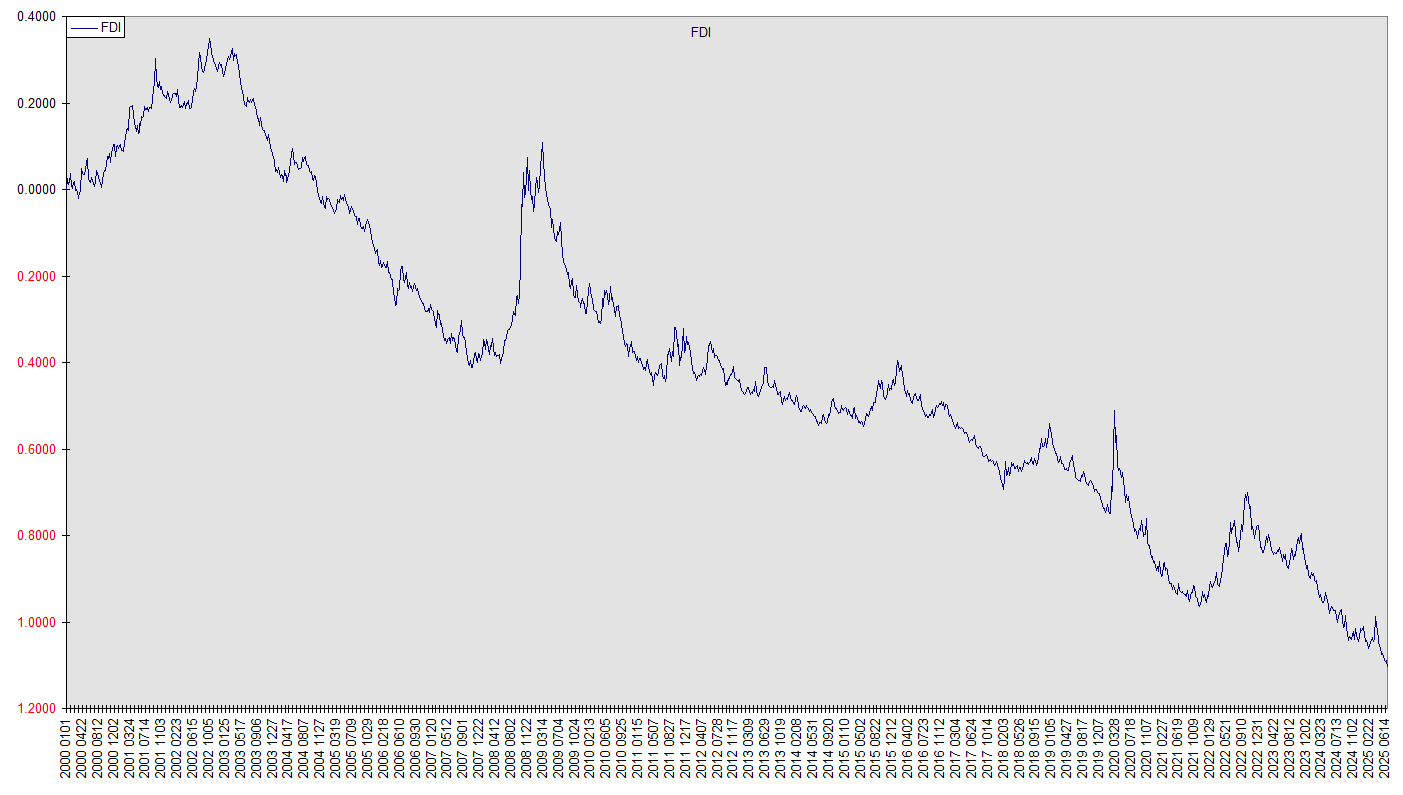

Financology Dollar Index

FDI 20250906

The FDI is an index of the value of the USD dollar in terms of human time.

The FDI is posted on the Synthetic Systems page accessed from the site menu. This chart covers the period since the turn of the century. Notable features are the persistent depreciation (inflation) marked by occasional sharp reversals higher, especially the one associated with the 2008 deflationary crash. This compares with the 1930s deflationary crash seen on the longer term charts. On the far right is visible the recent acceleration in inflation.

Financology commenting guidelines can be found on the site menu at Comments.

This extends the above chart back another century.

FDI 1900-2000

The charts tell a story. USD started its final descent a little after 1913, as the Fed began to do its dirty work. But the US was still constrained by its gold link, and the conflict created a train wreck, resulting in the Great Deflation of 1929-1933. Thereupon the gold standard was broken, allowing the inflation to resume. The abrogation of the international gold link followed in 1971. It too was broken.

The next constraint was the zero bound. That resulted in the Great Deflation of 2008-2009 (2000-2025 chart). The Fed then broke that constraint by directly monetizing debt, allowing inflation to resume.

It’s as if each constraint were a fuse, whose blowing was a warning. But instead of heeding the warning, the regime stuck a penny in the fuse box.

Eventually the house burns down.

All Fiat goes to zero

The USD is well on its way. Just this week it hit an all time low of 1/3599.74 ounces of gold.

https://www.gold-eagle.com/

I don’t think there’s a chance.

Is the 60/40 portfolio dead? Larry Fink thinks so — here’s what that means for you and your investments

Larry Fink says the 60:40 stock:bond portfolio is dead. I agree. An all-financial-asset portfolio never was complete. He says the new portfolio is 50:30:20 stocks:bonds:private assets. I disagree. I think a better replacement is 60:20:20 stocks:bonds:commodities, with the commodities being mainly gold. And the stocks part being the world stock market, not just the US.

Fink says that “private assets” are becoming available to ordinary investors. But making that transition begs the question of just how “private” assets are if they’re available to the masses. They are not truly a new asset class, they’re still equity and fixed income, just parts of those markets not traditionally accessible to ordinary investors.

As for realty and gold, they have been publicly owned and traded for decades, with realty included in equities in the form of real estate equities and gold in mutual funds, closed end funds, and exchange traded funds.

A simple three fund portfolio of VT, GOVT, IAU would be all many American investors would need. We financial geeks might like more to play with, but could still be hard pressed to consistently outperform just those three.

The $1000 Rule???

Retirees should stick to the $1,000-a-month rule

This should be called the Slow Motion Disaster rule. It advocates replacing the 4% rule – that says to plan on withdrawing 4% of your retirement savings annually – with what is in effect a 5% rule. You’re advised to save $240,000 for each $1000 in desired monthly retirement income. Nowhere does the article actually point this out, but $1000 monthly is $12,000 annually, which is 5% of $240,000.

Many retirement planners were already uncomfortable with 4%, citing among other things life expectancies and the low prospective returns associated with high asset valuations. An even more aggressive 5% is going the opposite way.

In reality there are an infinite number of $1000 rules. Just divide the annual $12,000 by your percentage of choice.

A 4% rule would translate into $12,000/0.04=$300,000.

It’s not just the percentage that poses the risk. The 4% also typically advised retirees to withdraw 4% in the first year, then adjust that dollar amount for inflation thereafter. No accommodation is made for how your portfolio subsequently performs, eliminating all feedback. This gave rise to new risks like that of poor performance early in retirement causing premature depletion of funds … so-called sequence of returns risk.

I advocate going the opposite direction. Withdraw 3% each year, with the 3% being based on the portfolio value at the time. Because it responds to the available assets each year, there is no possibility of depleting the portfolio. There is no “sequence of returns” risk. This is due to the feedback, and will work whatever the percentage withdrawn. The 3% merely ensures that the likelihood of diminishing real value of portfolio withdrawals is also early nil.

Turning it around into a $1000 rule, for each $1000 in desired monthly income, you want $400,000 in assets. Not $240,000. The difference is between a comfortable standard of living in retirement and big disappointment.

Does anybody actually think about this stuff before they write about it?

“To get a more accurate gauge of your retirement savings goals, start with the amount of money you anticipate needing your first year of retirement, Bill Bengen, the financial planner who invented the 4% rule, recently told CNBC.com.

Then, take 20 times that first year withdrawal amount to get a rough savings goal estimate, he said.”

https://www.cnbc.com/2025/09/09/retirement-will-take-a-miracle.html

So the putative originator of the 4% rule is being quoted as recommending a 5% rule. There’s no acknowledgement of the change, let alone rationale for it.

1970s Nixon Rerun: Why Hartnett Is Betting All On Gold, Crypto And Yield Curve Control

Zerohedge story………….BTW what is Yield Curve Control?

“Yield curve control” is a euphemism for desperate debt monetization wherein the central bank sets rate targets across the maturity spectrum and buys whatever quantity of securities is necessary to reach them. It’s more aggressive than QE (quantitative easing) because in QE the quantity is targeted and rates can still go where they may. In YCC the quantity is unlimited.

Ah……………….print their way out

Exactly. Hartnett is saying ‘Buckle up!’

Historically bonds “balanced”stocks for a limited period. They no longer work if bond mean treasuries or ig bonds. There are vehicles like mlps, bdcs, oil and gas and coal royalty funds, senior loan funds which pay much higher returns and have histories of their performance (limited default) in normal times, Recessions and even during “the great recession.”. Corporate credit doesn’t require great performance from a company, just that it doesn’t go bankrupt. Fwiw I’m 40% in such vehicles. 28% in phys, 7% gold miners, 20% real estate.

How effective bonds are in diversifying stocks depends so much on why stocks are going down. If stocks are going down because of economic weakness, bonds can be a decent hedge. If stocks are selling off because bonds are, bonds are useless. Exhibit A: 2022. Of course the trick is in anticipating in advance which is likely to be the case, which if you could, you’re a prescient market timer that probably doesn’t need a routine hedge!

The next episode could be mixed. Economic weakness is building, but if Washington responds with even more deficit spending, it could spook an already nervous bond market.

Either way though, bonds are no longer in a secular bull market. That ended with the 2020 blowoff top. Since then savvy investors have replaced part of their bond allocations with gold.

R.I.P. 60:40.

Bessent channeling Finster?

“Sept 5 (Reuters) – U.S. Treasury Secretary Scott Bessent on Friday called for renewed scrutiny of the Federal Reserve, including its power to set interest rates…”

Treasury Secretary Bessent calls for “entire” review of Fed

Mega’s Sunday Dispatch:-Geo politics, its a Gas Gas Gas

So here we are, post Big Trouble in Big China meeting where Russia has agreed to ship gas to Asia, gas that was being shipped to European nations. We had a reaction from the Western ind complex, nothing like the blind spitting fury that we had when Biden pulled out of Againistan WITHOUT “Discussing it” with their British “partner’s” 1st.

Nope, it was a still anger, but with some resignation to the fact that the World is changing…a lot!

The cheap plentiful energy that built European industrial power, the one thing that made it competitive on World markets…..is going almost gone.

THe Wet dream of breaking Russia is all but over, with Back up from India/China etc means any further action from the West is pointless. USA is NOT coming & even if the City of London Scum got a DNC Prez, they still would not come.

Now it remains to see what going to happen next?

The British Lib Elite attempts to turn Blighty into some Euro-North Korea is not going well. Trump made it very clear that the US IS willing to intervene, they are unwilling to allow what the ruling British elite want.

Europe has raised its threat level from miffed to peeved.

Best comment of the thread!

https://www.telegraph.co.uk/business/2025/09/08/why-even-an-imf-bailout-couldnt-save-britain-now/

Why even an IMF bailout couldn’t save Britain now

There are crucial differences between the UK’s current economic challenges and those of the 1970s

Bailouts from the International Monetary Fund (IMF) are painful.

Five decades ago, Britain was on the receiving end of its biggest-ever rescue package after a sterling crisis and bond buyers’ strike forced Labour chancellor Denis Healey to go cap-in-hand to the Washington-based institution.

After years of the country living beyond its means, a $3.9bn (£2.9bn) loan was granted in exchange for Britain agreeing to higher taxes and the deepest cuts in government spending on record.

Some are now asking whether history is on course to repeat itself. Rachel Reeves has been forced to deny that Britain is heading down this path. The Chancellor this week dismissed the prospect as one that had not been considered by “serious” economists.

But Britain’s credibility is on the rocks. Bond markets are watching nervously, with 30-year borrowing costs now at their highest levels since 1998.

In many ways, things are very different now to the 1970s. Britain has full control of its currency – which means the Bank of England can print the UK out of trouble if it needs to, even if it would make Britons significantly poorer.

There is also the question of whether Britain is simply too big to rescue, even for the IMF.

The world’s lender of last resort is funded by its 191 member countries, from Austria to Zimbabwe, which together have provided the fund with financial firepower worth roughly $1tn.

Its current bailout programmes are worth $120bn with Argentina by far the biggest recipient of IMF cash at $40bn, followed by Ukraine – which has a $10bn rescue programme – then Egypt and Pakistan.

There are strict rules surrounding how much the IMF can lend to countries in crisis. Every nation has a so-called quota of cash known as special drawing rights, linked to the size of its economy.

The UK’s is worth roughly $30bn, compared with $120bn for the US and $43bn for Japan.

IMF bailout rules deem that countries can borrow up to three times the amount they have put in. Anything above that and the government of the day has to apply for “exceptional access”, which is linked to harsher conditions and much higher interest rates.

The sums involved are not insignificant: roughly three times Britain’s quota would be £67bn.

But in reality £67bn would just be about enough to keep the NHS running for four months or pay the state pension for six.

The Government is expected to borrow just shy of £120bn this year alone to plug the gap between tax receipts and government spending. It also has to issue more than double this amount when refinancing is taken into account.

There is also the political challenge of going cap-in-hand to an institution with a reputation for punishing the populations of countries it lends to.

If Britain were in need of more than £67bn, the IMF’s whole lending model could be under threat.

Who’s gonna bail out the IMF?

The US wants the World to move to Crip-toe so they can carry on the ponzi but the World wants GOLD. I note that Africa wants reparations for Slaves/colonial plunder. You want their stuff?……fine pay a fine & real money!

The anti-establishment argument for crypto is wearing a little thin, considering how heavily promoted it is by establishment media.

Odd too how the world’s central banks are buying gold … except for a few that are heavy into their own government paper. We will see how that turns out…

Gold & Silver catching bids……..

Gold at a new all time high as I type.

$3657.96

https://www.msn.com/en-us/money/savingandinvesting/president-trump-s-tariffs-could-sink-the-stock-market-but-investors-have-another-serious-problem/ar-AA1MaTpS?cvid=68c0409399fc422e8fa7a98ba8838833&ei=30

“President Trump without evidence claimed the numbers had been manipulated to make him and the Republicans look bad.”

MSN claimed without evidence that the slowing numbers were caused by Trump’s tariffs.

Trouble is the economy is slowing, a lot

I think it is for real. A woman I know has just had her hours cut at a local manufacturing shop that until recently was bustling with work. Sure, it’s anecdotal, but I don’t trust government statistics unless I can find support elsewhere.

Assigning cause is problematic. We had a deep and prolonged inversion of the yield curve that ended less than a year ago, normally an omen of recession. If anything, we were overdue. While I don’t think Trump’s helter skelter approach to tariffs has been helpful, the roots of this slowdown predate it. In any case, the amnesiac, agenda-driven corporate media let no opportunity pass, however tenuous, to cast Trump in a negative light and haven’t since 2016.

My point isn’t to defend Trump but to criticize the media. The hypocrisy of demanding evidence to support Trump’s position while offering none to support its own is striking.

Agreed, same here………….but its slowing, a lot!

I am deeply concerned, while i try to be a heartless bastard, but i recall a young man 40-45 years ago looking for work how tough it was. The hopeless of it, the lost years …not good

Ditto. I’m concerned for my friend; cutting hours is often a prelude to layoffs. She’s being proactive, already applying for other jobs, but once manufacturing slows down everybody starts looking for service jobs and the openings fill up fast.

Might get some good music & films though

i don’t mean “Alien 23” or “Terminator 21″…….new stuff, new ideas

Some kind of reset is desperately needed. We have epic malinvestment in frivolous novelties, while infrastructure crumbles, the quality of food, medicine and education languishes, and millions can’t afford a decent home and are upside down even on their cars. The sooner the better … the longer this goes on the more painful the reckoning.

RIP Charlie Kirk

Interesting

https://www.autocar.co.uk/car-news/new-cars/industry-plans-new-small-affordable-car-class-backed-eu

About Bloody time

https://www.telegraph.co.uk/money/consumer-affairs/motability-claimants-lease-second-hand-cars-not-bmw/

UK growth figs just came out …..0%

Normally they manage to massage something to look like growth……get 0.3 or 0.2 but they could not even do that this time around……..i feel like the Economy is like that Nuclear reactor in Ukraine that blew in 1986……………”3.6, not great, not terrible”

aLL MOST GOT A JOB WITH THESE GUYS IN THE 1980’S

https://www.business-live.co.uk/enterprise/more-100-jobs-go-engineering-32446336

You are an engineer?

Yes, used to run CNC lathes/milling machines………then after working for one VERY bad employer (who went bust 2 years later) i left to run my own company for 15 years until China arrived………….& wiped out the industry (Architectural fittings).

I then joined the British Home Office……(Homeland security)

Hmmm … I was a musician, then got a degree in engineering and went to work for the government, where I started in a technology role specializing in lathes and milling machines.

Next week the Federal Reserve Federal Open Market Committee meets, and is expected to announce a reduction in its Federal funds target rate. The financial media will be transfixed. Financology expects to cover it as well per its practice extending all the way back to the days of iTulip Finster’s Comments.

But as I have increasingly emphasized, it’s far more useful to watch the bond market. Few if any of us borrow or lend at Fed funds, and as James Rickards points out, not even the banks do much of it any more. Besides, wherever the Fed is going, the bond market gets there first. In Rickards’ own words:

“The Fed is not leading the market to lower rates; they’re following the market.”

All Eyes on an Irrelevant Fed

Rickards also by the way joins me in skewering the ballyhooed notion of “Fed independence“.

Like JR, i read some of his books, passed them across the office.

Mike Maharrey regularly hits the bull’s eye:

It’s Zombie Inflation

Gold at a fresh all time high of $3678.89 as I type. Up 1.01% since last week’s close. Copper up 1.54%, silver up 0.89%. Stocks (VT) up 0.49%, bonds (GOVT) up 0.13%, commodities (SPGSCI) up 0.90%. Platinum leads the four metals year to date up 51.23%.

Inflation is rampant.

Nonononono.

Trump advocates end to quarterly earnings reports

“”Did you ever hear the statement that, ‘China has a 50 to 100 year view on management of a company, whereas we run our companies on a quarterly basis??? Not good!!!'” Trump said.”

Okay, so China is taking a 50-100 year view and we’re going to go from 3 to 6 months?

Trump couldn’t be wronger on this. We do have a short-termism affliction, but is it not caused by quarterly reporting and it is not going to be fixed by semiannual reporting. It’s caused by executive compensation being keyed to stock price, especially with stock options and manipulable via share buybacks. If you’re serious about it, instead of applying cosmetic bandaids, eliminate all executive compensation tied to anything less than four years from the date of performance.

Few business leaders use their own money to buy their company’s stock without exercising of options, which allows them to purchase shares at a fraction of their market price.

– MSN Money

Yep Gold/Silver up…………

Mega’s Dispatch from England:- “Is that a Dagger i see in thy hand?”

Things moving quickly now, all out attack on Blair/Fabian Labour in full swing. Over the weekend it was “discovered” that Peter Mandelson the British ambassador to the US was great pals with one Jeffery Espisten.

it seems he was forced on Starmer by his political masters to “Run the shop in Washington” & interact with Neo com US political types (City of London agents). “Mandy” refused to go so Starmer had to sack him over the weekend.

Now tonight Dave Davis a GREAT Tory MP has tabled an emergency debate tomorrow in the house of commons ……to ask the PM a few questions……….what the PM know & when did he know it?”

Having failed 100% to bounce the US into WW3 or get them to fund an extended war in Ukraine he must go!

John Mauldin gives a good overview of where monetary policy is and how it got there, with subtext on the explosion of wealth gap. Digging deeper, we can discern the seeds of the explosion of federal debt in this tragedy.

Modern-Day Punchbowls

Next let’s contrast Mauldin’s assessment with an MSM portrait:

Inflation is hitting some Americans harder than others

According to this piece, the history of inflation started this year. Tariffs are the cause of inflation and the wealth gap. The Federal Reserve’s monetary policies, its printing of trillions and years of ZIRP, are not mentioned.

The exercise of identifying the more honest reporting on inflation is left to the reader.

Running for the doors

https://www.telegraph.co.uk/business/2025/09/16/uk-stocks-dumped-at-fastest-pace-20-years-ahead-of-budget/

Let’s unpack a bit the theory behind the FDI. It’s stated to target the value of the dollar in terms of human time. Why? How?

Let’s do the why first.

I take it as axiomatic that human time is the fundamental invariant of economic value. There is no economic value without it. What for instance would be the economic value of an iron mine, an ounce of gold, a golf course, or an iPhone without humans?

Human time is also the one thing each and every one of us has in the exact same quantity each year. Moreover, that amount has remained unchanged since the dawn of the human race.

But what sets this apart from measures of value like a basket of consumer goods and services? That’s a “things” based measure of value. Measuring the value of the dollar in terms of things assumes that things themselves don’t change in value. That’s demonstrably false. A buggy whip does not have the same value in 2025 as it did in 1925. And an iPhone certainly did not have the same value in 1925 as it does in 2025!

reductio ad absurdum

So why might be a consumer goods and services standard have become the de facto standard in the economics community?

It results in a lower reported rate of inflation. As technology lowers the real cost of producing goods and services, they become less expensive in real terms. So using consumer goods and services as a standard makes inflation appear less than it really is. And the field of economics is dominated by political and financial interests that benefit from inflation.

Now for the how.

This is not so simple. How in the world do you measure the value of something in terms of human time? Wages and salaries present themselves as obvious candidates. But trading one’s time for dollars is more than a statement about the value of dollars and one’s time. I for one would demand more dollars for spending an hour as a window washer on the fiftieth floor of a skyscraper than I would in the comfy office on the other side of the glass. Wouldn’t you?

Moreover, not every transaction in the world involves an exchange of dollars. It might involve an exchange of some other currency, through which we could infer a dollar equivalence via exchange rates. If we want our measure to be truly universal, it can’t be parochial, but has to be global in scope.

We have to take an indirect route. We know the total rate of human value; we can derive it from our definition. It’s the total world population times the time for which it exists. So the total economic value of 2025 for example would be about eight billion human years.

We have estimates of the total world dollar value of GDP, GNI and related statistics. Using this data a conversion factor between total economic value in human hours and the total economic value in dollars can be derived to yield hours per dollar. But it’s still more complicated than that, because we don’t have data for the current year, let alone for the current week, the frequency with which we’d like to calculate the value of the dollar.

So besides the fact that even measuring economic aggregates like world population and GDP is itself an exercise in estimation, we have to take a less direct approach, using data that is available weekly. The uncertainty factor is however somewhat offset by the greater accuracy of the data. All told, the FDI is an imperfect measure of the value of the dollar. It is, however, much less so than any other published data I am aware of, conspicuously including the CPI and PCE.