There’s much ado in the financial media about the recent collapse in money supply. The steepest since the 1930s. Financial Armageddon surely awaits, right?

Not so fast. Let’s look at the actual data.

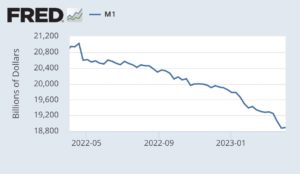

First, we focus on the locus of concern. Here’s a one year chart of M1:

Pretty scary, at least if you’re up to your neck in stocks or fretting about deflation. But wait … who says just the past year is all that matters? Let’s zoom out to the last ten:

Okay, now I have a little problem getting worked up about collapsing money supply. The past year hasn’t even undone the increase since 2021, let alone the post corona crash explosion in 2020. Money supply is about five times what it was barely three years ago, when the economy and financial markets were humming along quite nicely, thank you. Again, what time frame gives the proper perspective? I don’t pretend to have an answer for that, but does the Cassandra crowd? Do the latter’s denizens even bother to ask the question, never mind try to answer it?

This recency bias, incidentally, is not restricted to money supply. If the stock market, for instance, declines by 10% from top tick, it’s treated as a crisis, even if it leaves prices 20% above where they were a couple years ago. Pick the data that express you how you feel.

Is it possible? Is it possible that this longer term outsized money supply expansion helps explain why, despite the purportedly huge increase in monetary tightening over the past year, why the FOMC is still mystified as to the grudging progress on reducing final inflation? Why, even after 500 basis points of rate increases?

There are still multiple trillions of dollars more floating around in the system than in March 2020.

Money is not tight.

There just isn’t any shortage of the stuff. John Hussman does a deep dive in a recent article:

Fabricated Fairy Tales and Section 2A

Hussman puts some otherwise absent perspective on the current situation. You’ll want to read the article, but the gist of it is this: Money supply matters. The famous Volcker tightening was, for example, due to Volcker’s targeting of the money supply. Soaring rates, including Fed funds, were an effect of the tightening, not the cause. The Fed now imagines it can blast the system full of money and rely on rates alone to effect a tightening.

Don’t get me wrong. Rates desperately needed to rise, after being nailed to zero for most of the past decade and a half. That policy wreaked untold damage on the economy, blowing out the wealth gap and creating unstable bubbles and stultifying debt among other things. And the process of readjusting to more normal rates isn’t likely to be without trauma. You don’t shoot heroin for years on end and suddenly stop without severe withdrawal symptoms. For one thing, in combination with having reduced reserve requirements to zero in March 2020, it would be amazing if there weren’t problems with deposits leaving banks. Why keep your money in the bank earning a fraction of a percent when you can get 5% in a money market fund?

And if you stop shooting heroin and experience bad effects, is your misery due to a deficiency of heroin? Or the surplus that you got addicted to before? The Wall Street crybabies would have you believe heroin is an essential nutrient.

How do you uninflate a system without deflation? How do you unblow a bubble without a crash?

The damage inflicted by that huge spike in money supply on top of years of rate repression has yet to be fully felt. The yield curve is flashing red. So it shouldn’t surprise us in the least if indeed severe financial stress becomes obvious in the coming months. Just don’t blame it on that miserable little decline in money supply alarmists are crying about.

Blame it on the monster spike that came before. But either way, don’t blame it on whether the FOMC decides to hike another 25 bp in May or June or whatever. As we said before, rates are already plenty high. You can put me down in the camp that says the FOMC will indeed add another 25 bp to its Fed funds target. But not in the camp that thinks it’s a big deal.

i think the fiscal authorities deserve more “credit” for what’s happened since ~2005, with the fed-as-bank-supervisor an early co-conspirator. the fed-as-monetary-authority has been mostly a prisoner of feed-the-rich fiscal decisions, starting with bailing out the banks [and not cleaning out all the c-suites and jailing the miscreants] in the gfc. add the trump tax cuts for the wealthy, and the covid stimmies [including millions in ppp grants to big businesses] and we get that enormous leap in liquidity. for the fed to have not accommodated the fiscal decisions would have led to failed treasury auctions and economic crisis.

this is the era of fiscal dominance.

as former fed governor larry lindsey said: “It always ends this way. If you go back and you look at Rome. You look at the Ming Dynasty or you look at Zimbabwe – it always, always, always ends this way. And the question is how can you delay it… The end game we’re all talking about here is a very unpleasant one. It means that the financial arrangement that the state has created is no longer sustainable by society. And that’s how overly indebted societies end and they move on to a new type of arrangement. So it isn’t going to be a pretty change – if we get there. And that’s why it is so urgent that we act now. It is not just a matter of numbers. It’s a matter really of political liberty. Because the government will not voluntarily let itself go out of business. It will use all of its powers – I’m not talking about just our government but any government – will use all of its powers in order to fund itself… It isn’t hard to get the math to work for America to save itself – and that’s why I’m optimistic like my colleagues here that we could do it. But we’ve got to get on the wagon and get doing it soon because time is running out.”

I think the feedback loops both ways. Fiscal excess pressures the Fed to accommodate it, but monetary accommodation also encourages fiscal excess. That’s how interest rate cuts work … by making borrowing cheap, you encourage more of it. It does the same whether you’re a private borrower or a public borrower. It should be no surprise that the federal deficit rose rapidly during the ZIRP years. Now that rates are coming back up off the floor, we’re starting to see political pressure for renewed fiscal restraint.

Something is afoot. Only last Friday the yield curve upsloped into four months, then downsloped thereafter, indicating the market was pricing in rate cuts between four and six months.

Now on Tuesday the peak rate is at two months. So the bond market is pricing in a hike tomorrow but that short rates fall between two and three months from now.

i think the short end is being distorted by concerns about the debt ceiling.

Oh that’s right … that could account for the timing shift. Still, you have to wonder what would cause short Treasury yields to fall well below current short rates … even in the extreme event of default, wouldn’t you expect yields to rise? Today’s hike would put the Fed funds floor at 5.00%. One year UST yield is 4.74%. So for parity short rates would have to be well below Fed funds for a substantial portion of that year, while FOMC patter insists there are no cuts in sight.

Either the FOMC is wrong or the bond market is wrong.