The inflection point SS has been forecasting since the beginning of 2021 is at hand.

Recall that SS is never exactly right, and that even when it’s working well it doesn’t hit the bull’s eye. We’re glad to just hit the target. That said, the approaching time frame – the beginning of 2022 Q4 – has been in its cross hairs for several quarters. It’s been fascinating to watch as a narrative has fallen into place, piece by piece, consistent with SS projections made well before such developments were even on the horizon.

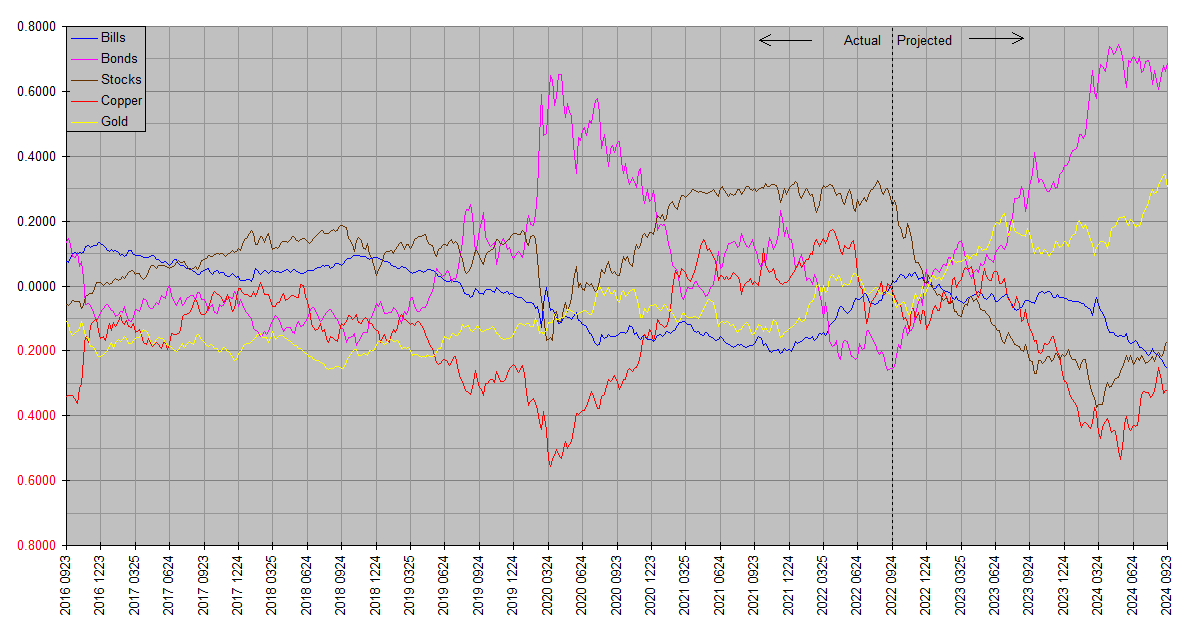

SS thinks Bills have a few more weeks of strength, and by extension, the USD, and that Bonds are near a bottom in the vicinity of October first. It foresees the bear market in Stocks gathering steam, as equities finally decouple from bonds. The Copper plot suggests further declines in commodity prices. It pegs the nadir of the current Gold downdraft around November eighth.

A full quarterly update is due next weekend. This will be the last of the weekly SS runs for the time being. Next week coincides with the regular quarterly update. SS will be in the shop for some further under the hood enhancements over the fourth quarter in the hope of having them fully tested and implemented with the 2023 annual update.

Many thanks Bill. Your commentaries and charts have been immensely useful in better understanding the happenings in the global economy.

SS is predicting a switch in the trend line of Bills where the weakening results in Gold to rise. Is this a case of Gold considered as a safe-haven?

Thanks, Sunpearl. Although financial analysts tend to rank assets in terms of safety versus risk, no one asset is truly safe by itself; the safest asset is really a combination. The following remarks about gold highlight this.

Gold competes with currencies as a form of money … when savers and investors are confident their more liquid currency alternatives won’t lose value, gold becomes less important to hold. As real interest rates on alternatives like Treasury bills, notes and bonds rise, they became relatively more attractive. Conversely, when they fall, gold becomes more attractive. So gold prices tend to inversely correlate with investors’ expectations of real yields.

As a technical model, SS doesn’t think in these terms, but its projections are consistent with it. It sees gold bottoming as bills peak, and it generally sees it rising as bond prices rise and yields fall. Of course it remains to be seen how accurate the forecast turns out to be, but I would be surprised if the markets did something entirely different, say, if stocks were to outperform bonds over the next few quarters.

Bear in mind that SS charts are not denominated in dollars; rather recognizing that dollars themselves vary in value, they show the relative performance of assets.

Thanks Bill.

Turmoil in the forex markets continues to weigh on Treasury prices. Japan for instance has reportedly been selling Treasuries to fund its operations to prop up the yen. This is a bit ironic because it is primarily the yield gap between JGBs and USTs that’s weighing on the yen to begin with, so lower UST prices and higher yields offset part of the effort. This is not a sustainable tack, however … the BOJ’s monetary policy – it continues to cling to negative yield targets out the curve long after the rest of the world has moved on – can’t hold back the market ocean for long.

What else to watch for … now that the fourth quarter draws near, the timing will be mostly up to the interplay between stocks and bonds. It’s unlikely bonds will recover without a sharp downdraft in stock prices. The Fed is looking for a tightening in “financial conditions” – Fedspeak for lower stock prices – so lower stock prices would go a long way towards satisfying its rate hiking goals. It needs something to break … and while one would think the drama in the forex markets, particularly with the yen first and now the pound, would be a big enough wake up call, equanimity in the stock market says so far it isn’t. When Wile E Coyote finally looks down, we’ll know it’s time.

Strategy wise, I’ve gone modestly overweight Treasuries, with a view towards going more deeply overweight once it’s clear the bottom is in. Neutral weight in gold, underweight stocks.

Cash USD and the shortest term UST – T Bills – have been the strongest performers of the major asset classes since the beginning of August. I continue to expect that to extend to longer term UST in the coming quarter.