Hot off the presses, this morning’s Synthetic Systems update.

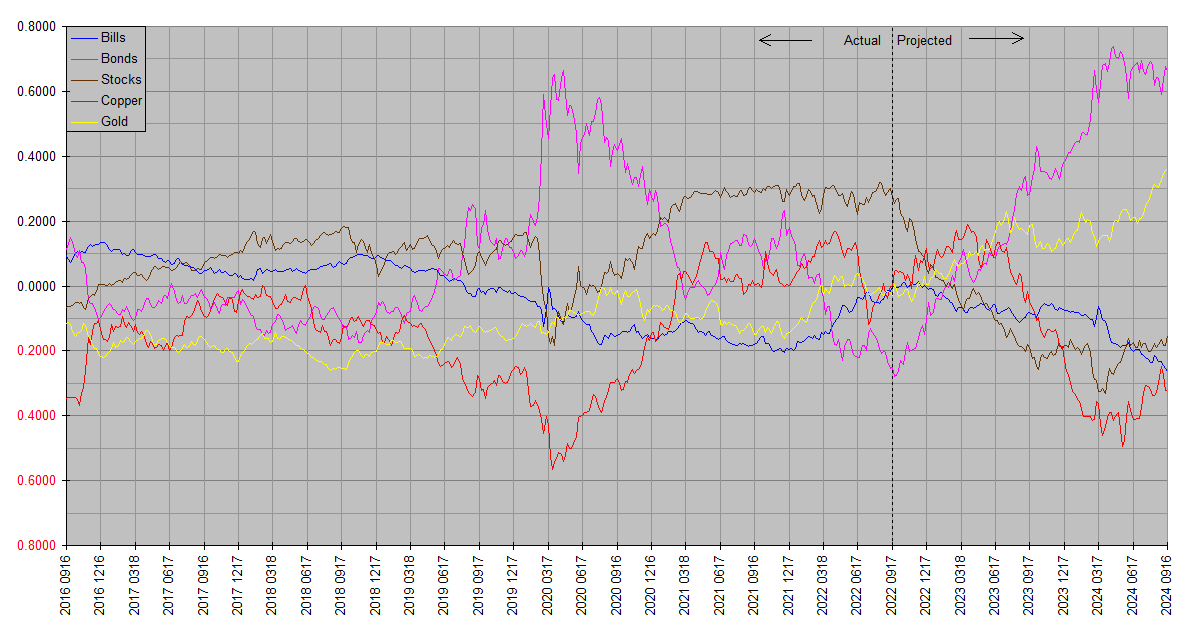

Synthetic Systems forecasts have been tracking the markets pretty closely, with one notable exception. They have consistently underestimated the appreciation of the dollar. This was most conspicuous this week in gold prices. Notice in the Actual portion of the charts gold has held up well in recent weeks, including the past week, even as owners of gold who do their accounting in USD have watched prices fall. Stocks have held up well all year despite declining USD prices.

The explanation can be found in the blue line. So far this year, Bills have been the best performing asset SS tracks, due mostly to their close tie with USD. The impressive rally in the USD, also evident in forex markets, is real and has resulted in lower prices across asset markets by virtue of it taking fewer larger dollars to buy the same stuff.

This is good news for the Fed’s war on inflation, because it is slowly trickling into consumer prices, albeit at a glacial pace. I fully expect the gradual retreat of trailing annual CPI growth from its June apex of 9.1% to continue, so long as that blue line doesn’t reverse to the downside. It’s also good news for consumers and investors who have been holding ample allocations of USD cash.

It’s bad news for those short the USD, that is, those who owe them. That’s a lot of individuals and institutions in our highly leveraged financial system. They have been on the receiving end of a massive wealth transfer in recent years, and those who have maintained that position this year have been giving some of it back.

As noted SS hasn’t distinguished itself in forecasting this. It has by and large gotten the other asset relationships – the relative performance of stocks, bonds, gold and copper – right, while the dollar’s performance relative to them, reflected in the remarkable rally in the Bills plot, has taken it largely by surprise.

The reason for this miss is a matter of conjecture, but could be that the Federal Reserve’s determination to counter consumer price inflation and support the value of the dollar is so uncharacteristic relative to the past several decades of experience. Because of this SS should be regarded as agnostic as to whether and how long it will continue, and we will simply have to exercise our own informed judgment on that point.

We have done that on several occasions this year, beginning as early as January in What’s Up With Stocks?, and again in April in Cash. Although this view isn’t fully reflected in Synthetic Systems, we still like cash.

A word about the Bond and Stock forecasts … there are also ample fundamental reasons to expect the change in relative performance SS has penciled in for October 1, but they don’t speak to timing. SS has been anticipating a major trend change right around that date for several quarters, as can be seen in the Market Analysis archive. Although it is still no assurance that SS will be correct, this consistency does imply less uncertainty around that time frame than is normally the case.

Michael Lebowitz at RIA has some interesting insight on the bond market:

https://realinvestmentadvice.com/yields-are-defying-yesterdays-logic

Thank you, Bill. I appreciate this.