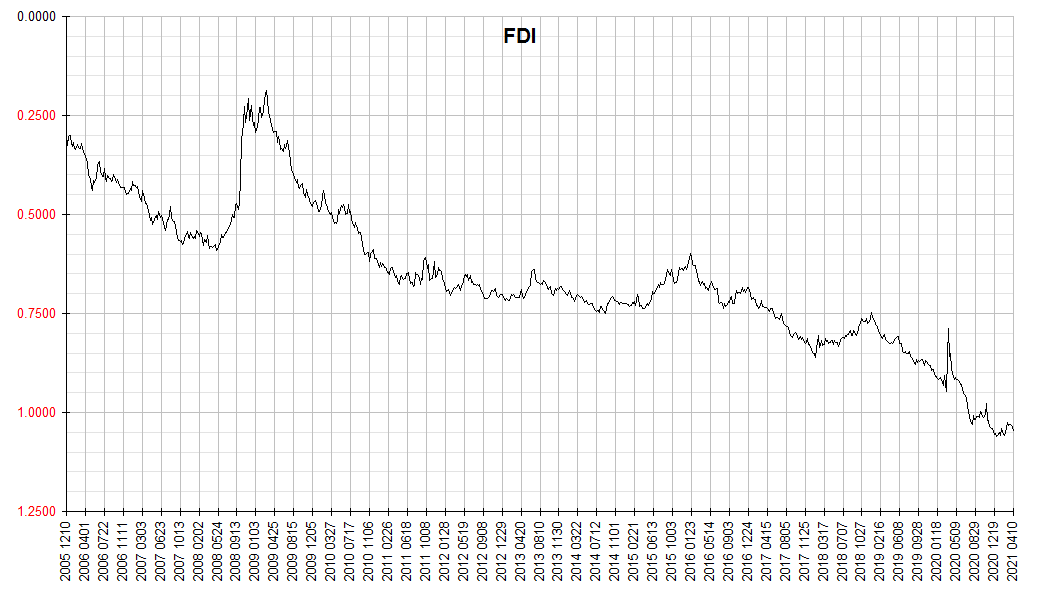

The latest read on the value of the US dollar:

As a reminder the Financology Dollar Index is a comprehensive measure of the value of the US dollar, taking into account not only US domestic consumer prices, but its value in terms of global goods, services, labor, capital … virtually everything with which the dollar is exchanged. The rate at which the dollar depreciates (appreciates) is the rate of inflation (deflation). The Consumer Price Index, often erroneously cited as a measure of inflation, generally not only runs lower than broad inflation, but also lags it in time and smoothes it, similarly to a moving average. So although the FDI is not fundamentally predictive of inflation, it does foreshadow changes in the CPI.

Inflation continues to track the accelerated trend that began when the Federal Reserve aborted its normalization program at the end of 2018. By this broad measure, the annualized rate of inflation from the end of 2018 to date is 12.6%.

Bear in mind that the 12.6% figure is based on a time frame beginning with a dollar top (inflation low). Using the same smoothing technique I usually apply, the rate of inflation comes to 9.5%. Either way though it’s much higher than that implied by the frequently quoted CPI and PCE series.

I think it’s more realistic. As Wolf Richter pointed out in Dollar’s Purchasing Power Drops Sharply to Record Low, But It’s a Lot Worse than CPI Shows, even the CPI would be showing 5.1% if it just used actual home prices instead of imputed rental equivalents. Richter has also detailed how the CPI hedonic treatment of car and truck prices has virtually eliminated all the price inflation in that space since the late 1990s. Real prices of course are up a lot. It’s not at all a stretch to imagine a CPI without the statistical massage giving inflation readings in the 9%-10% area. But even with the massage I wouldn’t be surprised to see the CPI registering well over 3% in the coming months as the lagged effects of inflation filter in.

Nor is it difficult to imagine why the government might want to fudge its figures. Social Security benefits, TIPS obligations, tax brackets, and many more things affecting the government’s obligations are indexed to the CPI. One of the core reasons we have such inflation in the first place is to reduce the burden of government debt. But now that a large portion of the government’s finances are indexed to the CPI, it not only has a powerful incentive to inflate, but also to inflate the margin by which actual inflation exceeds the CPI.

That the Federal Reserve is also on board is not especially surprising either given its established record of grasping at any justification available for holding interest rates well below market in its quest to levitate asset prices.

just a point of interest: shadow stats shows recent official cpi just under 3%, shows 1990-methodology cpi at 6%, and 1980-methodology cpi at 10%.

it’s a good thing they changed their methods a couple of times, because otherwise we’d have really high inflation.